/Blockchain Security Audits

Why does this matter?

Blockchain Audits: Your Key to Secure, Trustworthy Digital Transactions.

These audits help identify vulnerabilities, verify compliance, and ensure that blockchain networks and related components function as intended.

/What are the numbers?

The crypto industry lost $1,8 billion across 751 security incidents in 2023.

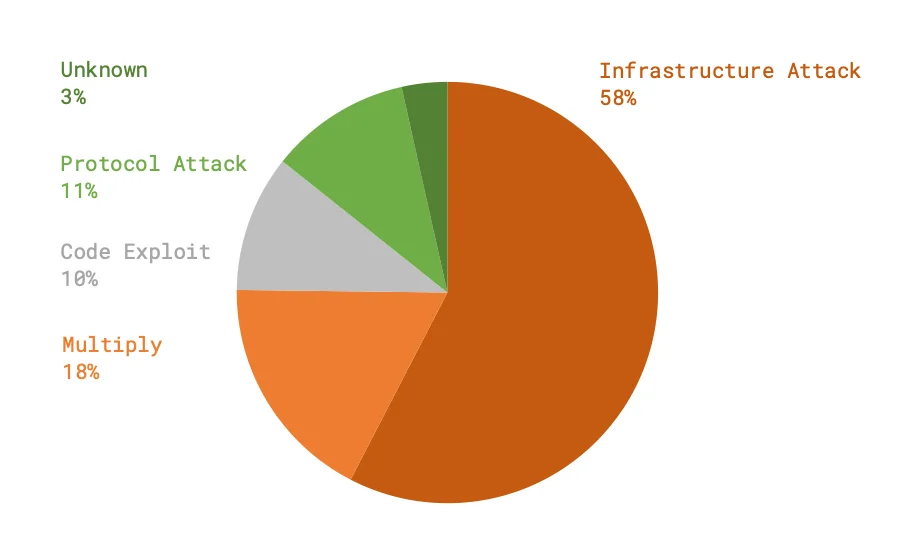

/Losses by the attack method in the crypto industry in 2023

Infrastructure attacks constituted almost 60% of the total stolen amount in 2023. The most detrimental form of infrastructure attack involved the theft of private keys or compromise of seed phrases. In such instances, hackers infiltrated the underlying infrastructure of a cryptocurrency system, including servers, networks, or software, to pilfer funds or manipulate trades.

With an average cost of nearly $30 million per incident, these attacks surpassed protocol attacks and code exploits, which jointly made up one-fifth of the total hack volumes. Similar to the trends observed in 2022, a limited number of large-scale hacks were responsible for the majority of cryptocurrency thefts.

The top ten hacks alone accounted for nearly 70% of all stolen funds. Notably, some breaches exceeded $100 million, including attacks targeting Euler Finance (March), Multichain (July), Mixin Network (September), and Poloniex (November).

/November 2023 blockchain security update: $349 million loss

According to SlowMist, November 2023 was marked by a significant number of security breaches within the blockchain sector. In total, 47 distinct incidents were recorded, cumulatively leading to a substantial loss estimated at around $349 million. This figure not only sheds light on the ongoing challenges faced in safeguarding digital assets but also the critical need for continuous advancements and stronger security measures in the rapidly evolving space of blockchain.

The combined losses from the Poloniex, HTX, and Heco Bridge incidents reached $243 million, accounting for approximately 69% of the total losses from security events. There were also 24 rug pull incidents, making up 51% of the total number of security events.

$2.1 mln (November 1)

$155,000 (November 6)

$290,000 (November 7)

$2.2 mln (November 7)

$2.4 mln (November 8)

$130 mln (November 10)

$6.7 mln (November 11)

$526,000 (November 14)

$9 mln (November 18)

$26 mln (November 19)

$113.3 mln (November 22)

$54.7 mln (November 23)

/November 2023 blockchain security update: $349 million loss

According to SlowMist, November 2023 was marked by a significant number of security breaches within the blockchain sector. In total, 47 distinct incidents were recorded, cumulatively leading to a substantial loss estimated at around $349 million. This figure not only sheds light on the ongoing challenges faced in safeguarding digital assets but also the critical need for continuous advancements and stronger security measures in the rapidly evolving space of blockchain.

The combined losses from the Poloniex, HTX, and Heco Bridge incidents reached $243 million, accounting for approximately 69% of the total losses from security events.

$2.1 mln (November 1)

$155,000 (November 6)

$290,000 (November 7)

$2.2 mln (November 7)

$2.4 mln (November 8)

$130 mln (November 10)

$6.7 mln (November 11)

$526,000 (November 14)

$9 mln (November 18)

$26 mln (November 19)

$113.3 mln (November 22)

$54.7 mln (November 23)

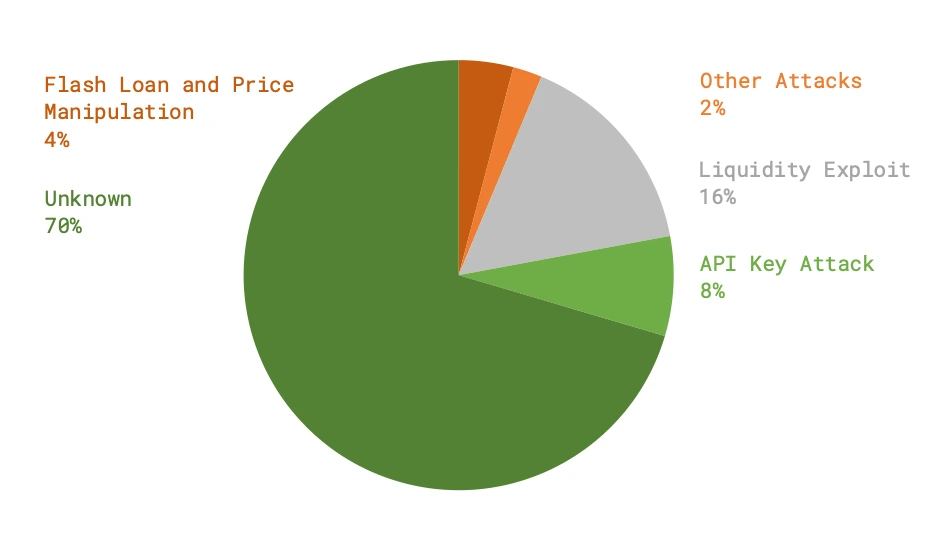

/Losses by the attack method in November 2023

“Projects are urged to intensify their oversight of liquidity pools, a crucial step in both the prevention and swift response to emerging security threats.

Notably, three major incidents this month were linked to vulnerabilities in third-party services, underscoring the necessity for thorough security assessments prior to their integration.

To enhance this process, projects may benefit from partnering with specialized security firms for comprehensive audits of these external services.”

/What is the solution?

The answer lies in preemptive action. Our Security Audits are not just evaluations but blueprints for constructing an impenetrable digital fortress.

/Audit Flow

-

Onboarding and discovery phase

Clearly state the objectives of the audit, which may include verifying the security, functionality, and compliance of blockchain systems.

-

Estimations and scope of work

Define the scope of the audit, specifying which blockchain components and systems will be audited, such as infrastructure, dApps, wallets, smart contracts, and more.

-

Prepayment and execution

Infrastructure, smart contract, dApp, or crypto wallet audit. Blockchain network security and governance analysis, and other check-ups

-

Audit report with recommendations

Compile findings, identified vulnerabilities, and recommendations for improvement in a comprehensive report.

-

Remediation and Follow-Up

Develop a remediation plan based on audit findings to address identified vulnerabilities and weaknesses. Conduct a follow-up audit to verify that remediation efforts have been successful.

/Customised solution

Your unique needs demand bespoke solutions. Choose from a range of service combinations to create a package that aligns perfectly with your specific requirements.

/Got questions?

Surely! We will validate and track controls and routines on your side to ensure high uptime metrics. This includes server infrastructure, operational infrastructure, automation tools, 24/7 monitoring, and incident response and management among other aspects (i.e., the way the team reacts in case servers/infrastructure are down, and procedures preventing that scenario).

- Smart contract vulnerabilities;

- Server infrastructure (data center location and provider, DDOS protection, etc.);

- Operational infrastructure;

- Scripts/chain integrations, automation tools, etc. used;

- Manual failover procedures (internal documentation, to exclude double-signing, etc. risks);

- “Heartbeat” monitoring 24/7 (alerts for up/down/respond states);

- Slashing insurance.

/Take steps to protect your business

Engage with us for a comprehensive presentation, a strategic pitch, or a sample of our meticulous audits.

We are not just a service; we are your first step towards a secure digital future.